Your dream home is within reach—never stop believing, and together, we’ll make it a reality. : Every journey to homeownership starts with a single step—don’t give up, you’re closer than you think. : The keys to your dream home are just around the corner—stay focused, and we’ll help you unlock them. : No goal is too big when it comes to your future—your perfect mortgage solution is out there, and we’ll find it. : Homeownership is a journey, not a race. Keep moving forward, and your dream home will be waiting at the finish line.Your dream home is within reach—never stop believing, and together, we’ll make it a reality. : Every journey to homeownership starts with a single step—don’t give up, you’re closer than you think. : The keys to your dream home are just around the corner—stay focused, and we’ll help you unlock them. : No goal is too big when it comes to your future—your perfect mortgage solution is out there, and we’ll find it. : Homeownership is a journey, not a race. Keep moving forward, and your dream home will be waiting at the finish line.

Benefits of Home Purchase Loans

Why Choose a Home Purchase Loan?

A home purchase loan helps you secure the financing needed to buy your dream home. With options for fixed or adjustable rates, this loan can be customized to your financial situation. Whether you’re a first-time buyer or upgrading, it’s a vital step toward homeownership.

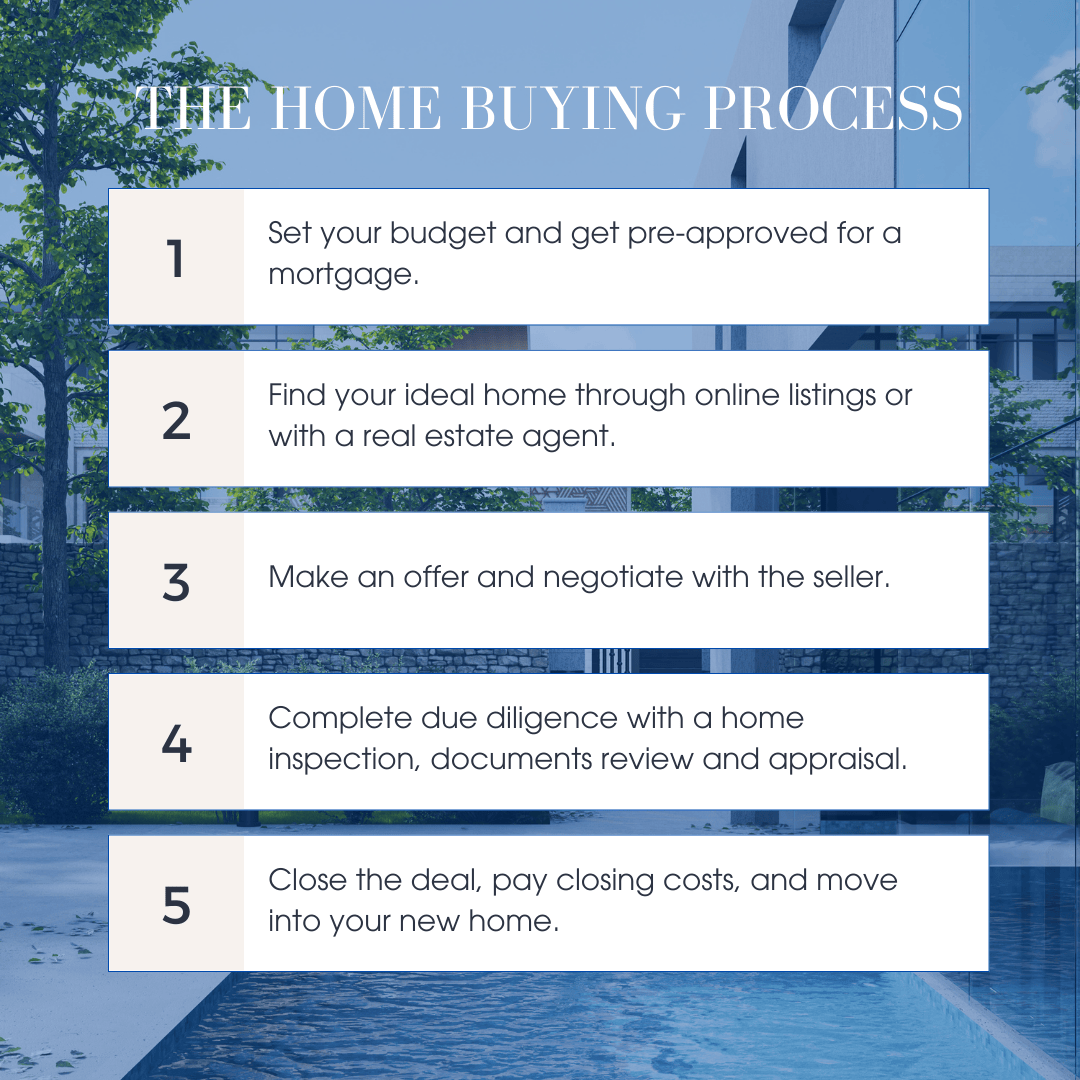

Understanding the Process

How Does a Home Purchase Loan Work?

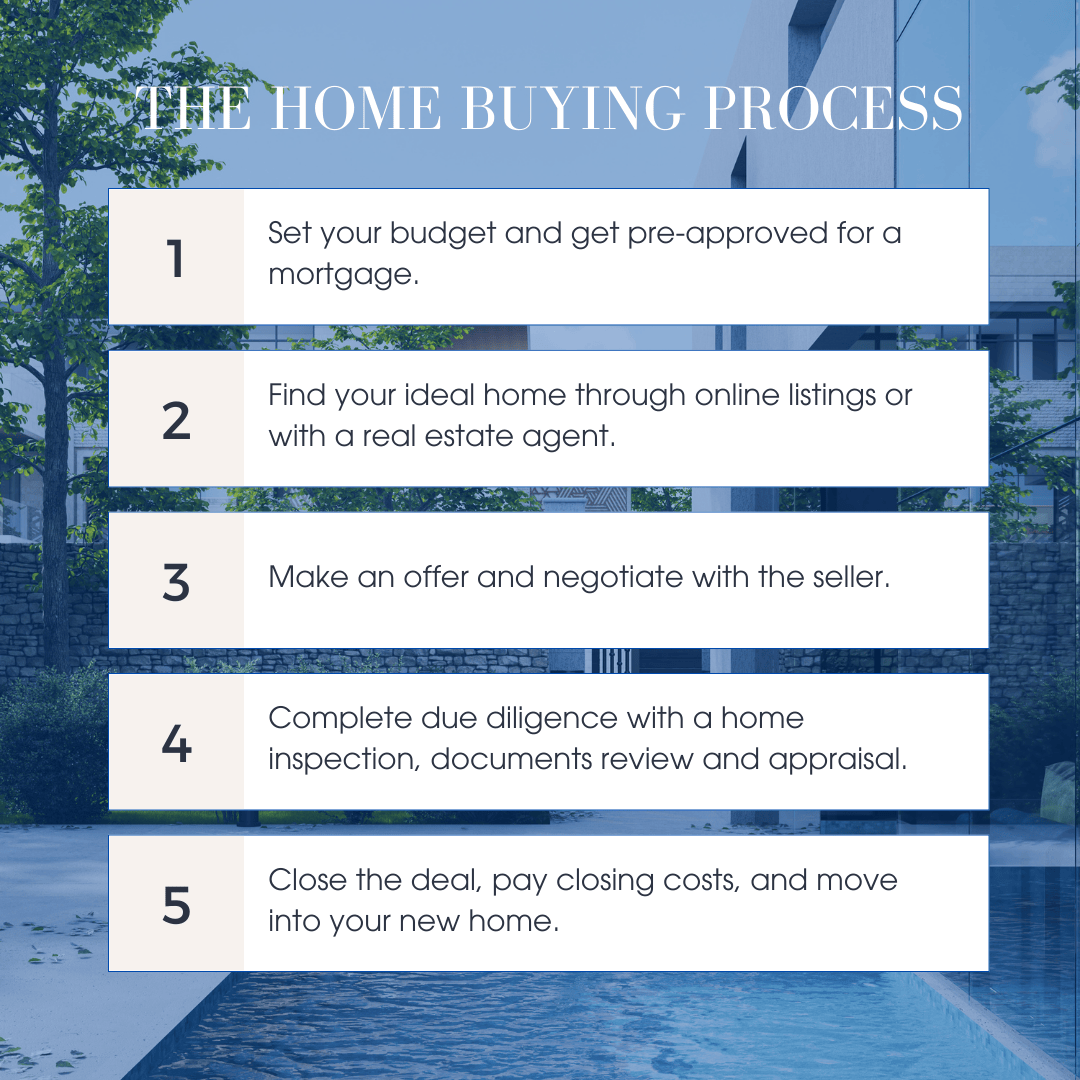

The home purchase loan process starts with pre-qualification, followed by finding the right loan type for your needs. After submitting necessary documentation, you’ll go through the approval stage. A closing will finalize the purchase, securing your new home with a manageable mortgage.

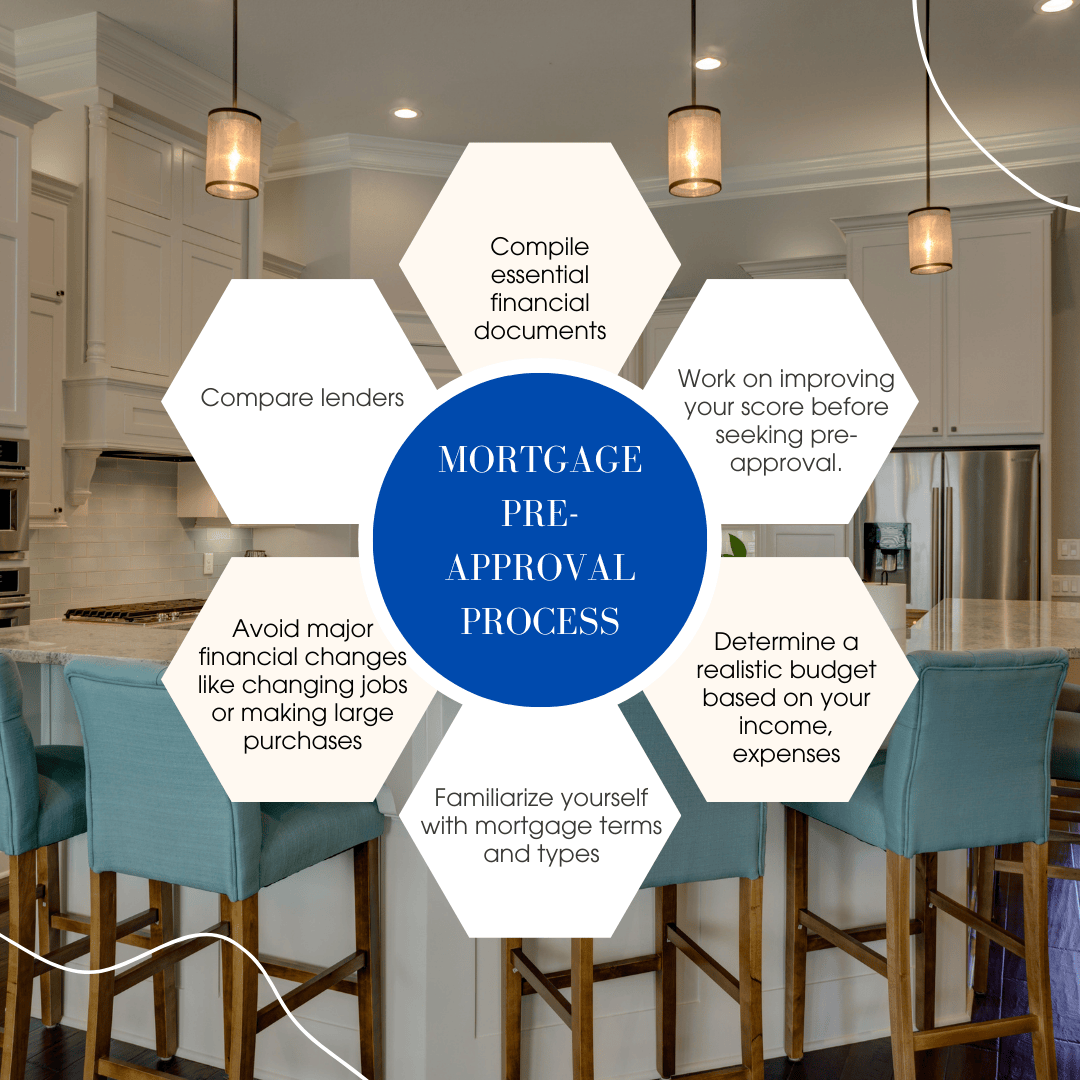

Take the First Step Toward Homeownership

Get Pre-Approved for a Mortgage Today!

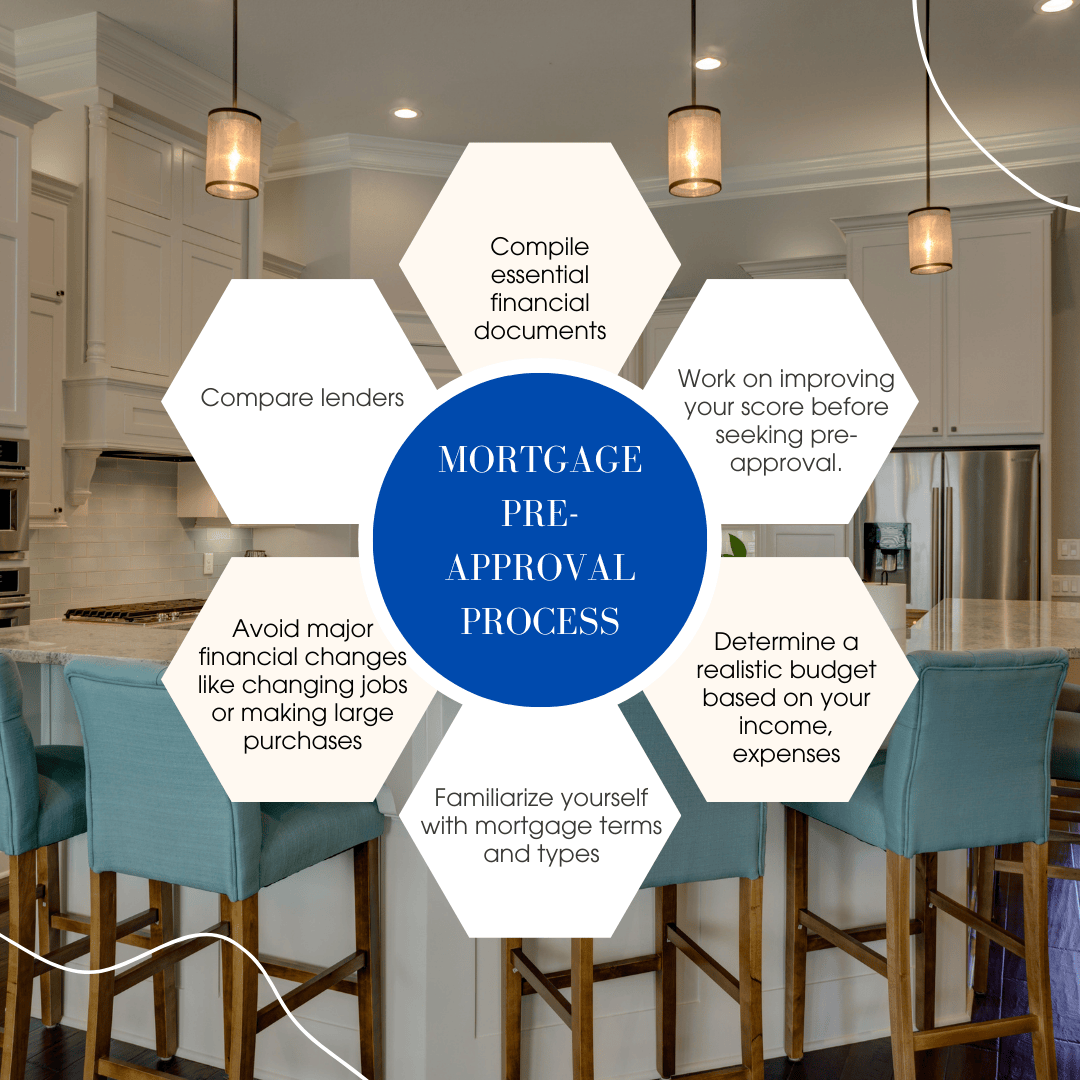

Start your home buying journey with a mortgage pre-approval. By getting pre-approved, you’ll know how much you can borrow, making it easier to find a home within your budget. It also gives you a competitive edge when making an offer. Our team is here to guide you through the pre-approval process, ensuring you’re ready to move forward with confidence.