|

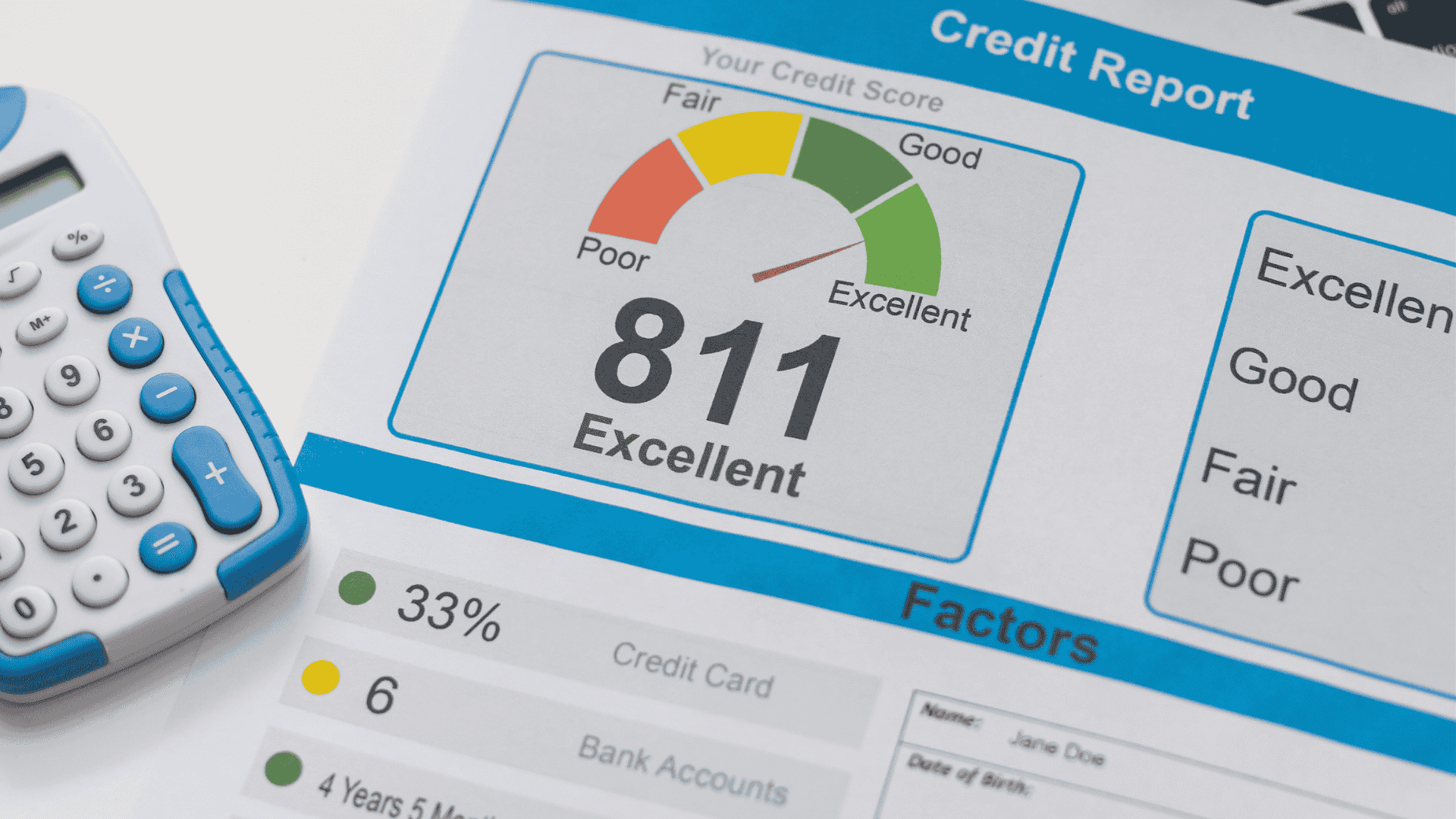

Improve Your Credit Score with These Simple Tips |

||||

|

A good credit score is essential for securing loans, mortgages, and credit cards at favorable interest rates. It can significantly impact your financial future, including your ability to purchase a home or a car. Improving your credit score requires consistent effort and smart financial habits. Here are seven effective tips to help you boost your credit score. 1. Understand Your Credit ReportBefore you can improve your credit score, you need to understand where you currently stand. Obtain a copy of your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. Review each report carefully for any errors or inaccuracies, such as incorrect account balances or payment histories. Disputing these errors can help you improve your credit score. You’re entitled to one free credit report each year from each bureau, so take advantage of this benefit. 2. Pay Your Bills on TimeYour payment history is one of the most significant factors affecting your credit score. Consistently paying your bills on time shows creditors that you are reliable and responsible. Set reminders for due dates or consider setting up automatic payments for recurring bills. Even a single missed payment can negatively impact your credit score, so it’s crucial to stay organized and keep track of your obligations. 3. Reduce Your Credit Utilization RatioYour credit utilization ratio is the percentage of your available credit that you are currently using. A lower ratio indicates to lenders that you are managing your credit responsibly. Aim to keep your credit utilization below 30% of your total available credit. You can achieve this by paying down existing credit card balances, increasing your credit limit (if you can do so responsibly), or opening new credit accounts. However, be cautious about opening too many new accounts at once, as this can negatively impact your score. 4. Diversify Your Credit MixHaving a diverse mix of credit types—such as credit cards, mortgages, and installment loans—can positively influence your credit score. Lenders like to see that you can manage different types of credit responsibly. However, only take on new credit when necessary and if you can manage the payments. Opening accounts just to diversify your credit mix can backfire if you accumulate debt you can’t manage. 5. Keep Old Accounts OpenThe length of your credit history accounts for a portion of your credit score. Keeping older credit accounts open, even if you don’t use them frequently, can benefit your score. Closing old accounts reduces your overall credit limit and can increase your credit utilization ratio. If you have old accounts with no annual fees, consider keeping them open to help maintain a long credit history. 6. Limit Hard InquiriesWhen you apply for new credit, lenders typically perform a hard inquiry on your credit report, which can slightly lower your credit score. To minimize the impact, limit the number of credit applications you make within a short period. If you’re shopping for a mortgage or auto loan, try to complete all applications within a 30-day window. Credit scoring models often treat multiple inquiries in a short period as a single inquiry, which helps reduce the negative impact on your score. 7. Monitor Your Credit RegularlyStaying informed about your credit status is vital for maintaining and improving your credit score. Consider subscribing to a credit monitoring service or using free apps that offer credit score tracking. Monitoring your credit can help you quickly identify any changes or potential issues, allowing you to take corrective action promptly. Additionally, keeping an eye on your credit can motivate you to maintain good financial habits and stay on track with your credit improvement goals. ConclusionImproving your credit score is a gradual process that requires patience and diligence. By understanding your credit report, paying bills on time, managing your credit utilization, diversifying your credit mix, keeping old accounts open, limiting hard inquiries, and regularly monitoring your credit, you can take significant steps toward achieving a healthier credit score. Remember, these seven tips to improve your credit score can lead to better loan terms and interest rates in the future, enhancing your financial stability. Are you ready to improve your credit score and unlock better financial opportunities? Start implementing these tips now and take charge of your financial future. For personalized assistance and strategies tailored to your situation, contact our team today! |

||||

|

|

||||

|

Disclaimer: ©2024 Rafael Arrieta Mortgage Lender. All rights reserved. |

||||

|

||||